Living expenses are high and Malaysian is getting more prudent when it comes to their finances. According to one of the article published in TheStar dated on 12th August 2019 “Malaysia’s Consumer Confidence Dipped in Second Quarter”, mentioned that majority of consumers have adjusted their spending habits to save on household expenses such as 48% of them spending less on new clothes, 44% of them trying to save on gas and electricity, 43% switching to cheaper grocery brands, 42% cutting down on out of home entertainment and 36% are reducing holidays and short breaks. Besides paying for essential living expenses, many still need to manage their loan such as housing loan, car loan, credit card and others. In other words, the commitment is rather high. What’s more, according to one of the latest article in TheStar dated on 5th September 2019 “Many Country Pushing For Higher Retirement Age”, it mentioned that life expectancy in Malaysia is 75.3 years old. In other word, majority of us may still live on for long period of time. And we certainly need money to sustain for our living.

What are the implications of the data above? It means, many working mothers may struggle to leave their job with all financial commitment mentioned above. Working mothers are pressured by the dilemma of being full time at work and neglecting their children or quitting their workplace but may neglecting their personal and family finances. In my previous blog “Full Time Job Vs Family”, I did mention that there is no right or wrong answer on the decision you made. It is all depends on what are your needs may it be social needs, financial needs, family needs or other needs at that point of time. One day, when I met up with my personal financial advisor to discuss on my financial planning, she mentioned that she struggled on the same issue many years back i.e. “Work and Finance Vs Kids” and she share with me that she found that midpoint between managing work / finances and kids. She started her personal financial advisory journey and discover the following benefits with the new job:

- Better Financial Management – As a personal financial advisor, she gain knowledge to manage money better in savings, investing and managing expenses for herself and her kids.

- Income – She earn decent income by helping people like me with her new role – provide personal finance advice according to needs and not just product selling.

- Time – She has flexible time with work and family.

Guess what, today she is also an author of her book “In/Outcome: Manage Your Income, Achieve Great Financial Outcome”. The key message here is we could always find our midpoint between managing work, finances and kids. All you need to do is to be ready to discover other opportunities in the market, dare to make changes and believe with the choices that you have made. Mom-preneur is certainly another options that many mothers are opting today to earn living yet gain the flexibility of time to spend with their kids and family. Life is full of choices and there is certainly a midpoint between managing work/finances and kids.

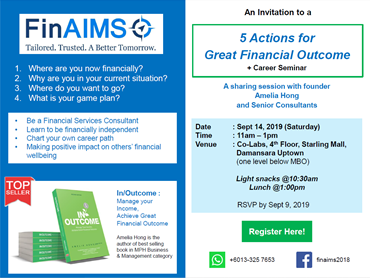

For sharing purposes, my financial advisor also shared that she is going to run an event on the financial talk for free. The talk is going to cover some common mistakes that people make when it comes to money such as saving, spending habits and others. She will share some important financial ratios that we should know to manage our financial position such as Emergency Fund ratio. For example: how long can your money last if you lost or quit your job? She will also do some real case study with the audience to assist the audience to have better understanding on their financial situation and provide suggestions. Hence, if any of you are interested, you may register for the below event. Hope the event will be helpful for any of you who always want to find out more about personal finances and perhaps you may want to explore your personal advisory journey with her too. What is better than asking her personally?

For more details, please click on the link below:

https://www.facebook.com/events/384147528965858/